SERVICES

PREPARATION, PLANNING, and PROBLEM RESOLUTION

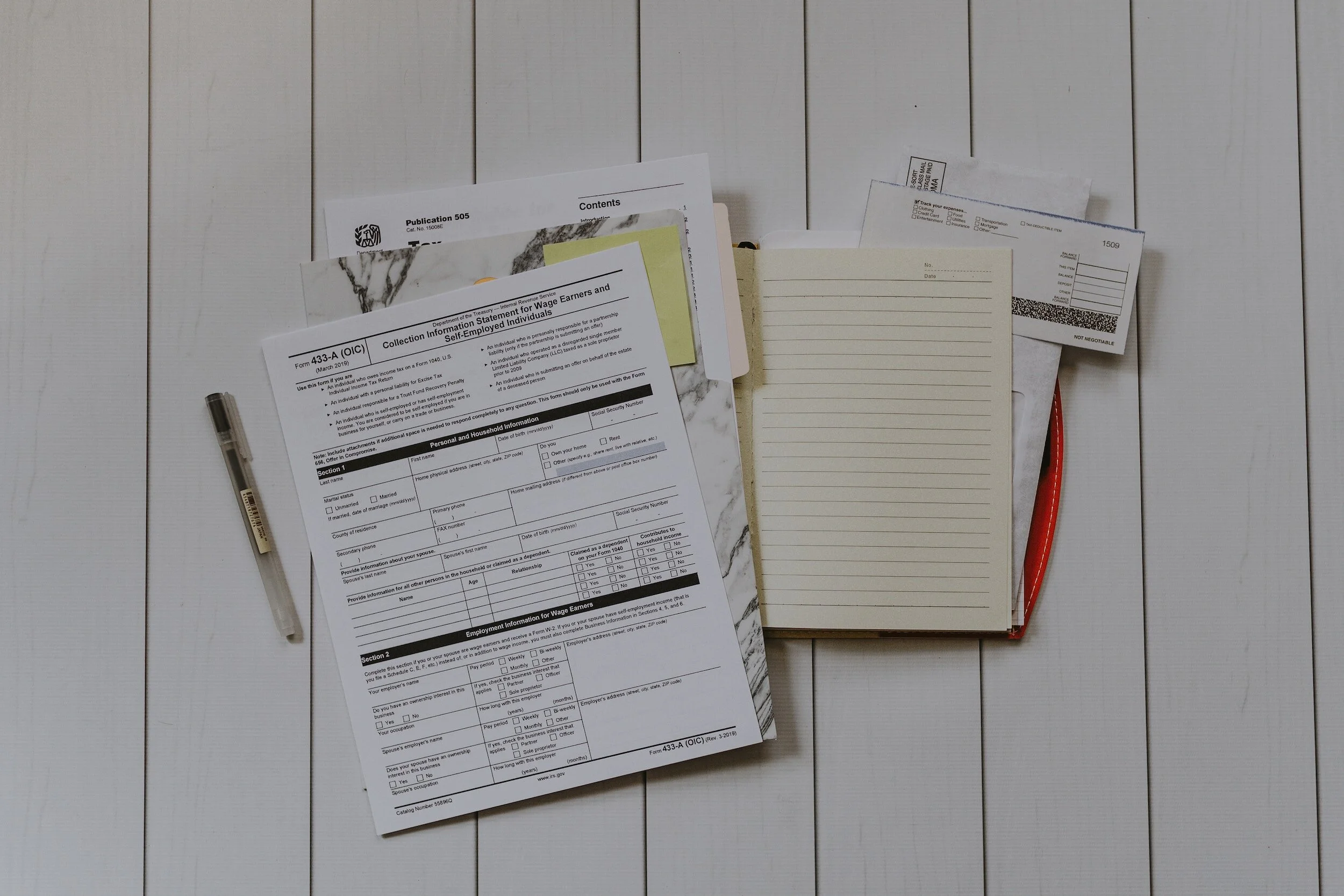

TAX PREPARATION

You can count on Krey CPA for accurate, timely, and secure tax filings:

INDIVIDUAL AND BUSINESS INCOME TAX

Federal and State returns with electronic filing

Quarterly and annual payroll taxes

Tax Planning

Business acquisition / sale and succession planning

Assist with IRS / State notices, audit, amendment, penalty abatement

Partnership AAR filings, change in accounting method

"You must pay taxes. But there’s no law that says you gotta leave a tip.”

– Morgan Stanley (advertisement)

TAX PLANNING

Tax Planning begins with an accurately prepared return using all tax savings and deferral techniques to your benefit – and avoiding unexpected pitfalls caused by fluctuation in income. The best plan of action is determined by your unique individual or business circumstances.

Some general strategies include:

Optimizing deductions and credits by investing in pre-tax retirement

Bundling of deductions such as taxes, charity and medical/dental expenses

Charitable IRA contributions

Roth conversion/recharacterization

Timing business equipment purchases to maximize deductions

Coordinating personal and business affairs

Assistance with calculating withholding or estimated tax payments

Utilize Estate, Trust and POA for long-term goals

PROBLEM RESOLUTION

IRS and other government correspondence can be confusing and stressful. Krey CPA can help!

Respond to notices(s), amend return(s), audit representation

File outstanding returns to establish compliance

Assist with payment plans, penalties or inability to pay

Over $120,000 penalties and interest successfully waived since 2015.

ACCOUNTING & BOOKKEEPING

QuickBooks® setup, cleanup and training

Account reconciliations

Bookkeeping support - customized to your needs from stand-alone reconciliation to full back office services

Year-end accounting for income tax reporting

Periodic review - monthly, quarterly, and / or annual services including journal entries and general ledger review

Customized reports and projections

Planning, forecasting, budgeting

Special projects - software implementation, data cleanup, Excel, convert accrual / cash